Why business cases are indispensable today

Marketing budgets are under fire, projects are competing for scarce resources, and every new piece of software has to prove its right to exist in black and white. Anyone who only has a gut feeling or a few PowerPoint slides to back up their case will be mercilessly outvoted at the next steering committee meeting. A business case closes this gap: it translates an idea into clear figures, evaluates alternatives, and provides a reliable recommendation for action. In the following chapters, you will learn how to systematically build a business case - from situation analysis to presentation to your bosses - and why a structured approach pays off, especially when introducing marketing technology.

What's a Business Case?

A business case is a fact-based decision paper that demonstrates why an initiative makes economic sense. It essentially answers three questions:

- What happens if we do nothing?

- What options do we have, and which one yields the best result?

- What are the costs, benefits, and risks over the entire life cycle?

The business case is therefore not a pitch deck or a vision paper, but rather a comprehensible bridge between the idea and the investment decision. The aim is to evaluate options in terms of figures in order to support a decision with long-term implications.

Why and when do you need a Business Case?

We have already mentioned that a business case should be used to prepare longer-term decisions and back them up with figures. This is because marketing technology involves IT projects, and even small IT projects can quickly swallow up large five-figure sums and the trend is rising. At the latest when

- CapEx or OpEx (accounting investments or operating costs) arise beyond the current day-to-day business,

- resources from other departments are tied up,

- strategic opportunities or risks (e.g., greater visibility or data migration and downtime) arise, or

- priorities in the project portfolio are reset,

management demands a business case. In short: Whenever a decision-maker asks, “Why exactly do we need this?”, you provide the business case by using figures to justify why you want to make an investment, why you want to use a new technology in a digital department or in marketing.

Important distinctions

Many people confuse the business case with other strategy or project documents. Here is an overview of the differences:

|

Criterion |

Business Case |

Business Plan | Executive Summary |

Project charter |

Business Model |

|

Purpose |

Investment decision |

Overall planning of a company |

Brief overview for stakeholders |

Project assignment |

Value creation logic |

|

Time horizon |

1-5 Years |

3-5 Years | 1-2 Pages | Project life time | Life cycle |

|

Financial focus |

TCO & ROI |

GuV, balance sheet, Cashflow | Minimal |

Budget framework |

Unit costs/gross profits |

|

Autors |

Technical/ |

Founder, Finance |

Different |

Project management |

Strategy |

So you don't have to create a separate document for everything. Often, a good business case with an executive summary as an overview at the beginning is sufficient.

Structure and components of a business case

Contrary to what many guides suggest, there is no DIN standard for business cases, even though they are always similar when it comes to introducing software. The following structure has proven itself in practice. To make it less abstract, we will explain it using the example of introducing a digital asset management system.

1. Situation Analysis

Before you start juggling numbers, get a clear picture of the status quo. With IT systems, you start with an internal analysis. The most relevant factors here are the existing processes, their stability, the systems used, and so-called pain points (e.g., effort due to faulty images or angry customers).

The next step is the external analysis. This focuses on the market and competitive situation. After all, we can only operate successfully in the long term if we acquire new customers. The aim is to document the “hot spot” clearly and unambiguously.

Here are a few specific points you should check:

- How do you currently obtain your assets? Do they have to be named manually and sorted into a folder structure? Apart from the fact that this is prone to errors, how much would you save if assets were transferred directly to the DAM system during the photo shoot?

- How much effort would you save with automatic tagging?

- When your colleagues search for assets, how much time could be saved by using a DAM system?

- When your assets need to be transferred to specific destinations, such as a website or marketplace, how much effort would you save if the DAM automatically linked them to products in the PIM and prepared them appropriately?

- How much can you shorten your time to market?

- What additional sales are possible because you can serve more marketplaces or better support your retailers?

- And especially for online retailers: What sales growth is conceivable if you can present your products better?

2. Objective & Scope

Clearly define what the project should and should not achieve. Measurable metrics (e.g., “reduce time-to-market for product images from five to two days” or “increase the number of assets on marketplaces from three to eight”) make it possible to verify success later on. You should definitely get involved in this. It builds trust with your superiors and gives you clear goals to work toward.

3. Option comparison

A business case always evaluates at least three scenarios: do nothing, a compromise upgrade, and the preferred solution. This includes investments, running costs, benefit streams, and risks, which you ideally monetize.

| Options |

Description |

Initial Invest |

Running costs p. a. |

Expected benefit p. a. |

ROI (5 years) |

Main risks |

| Do Nothing |

Maintain the status quo |

0 € | 0 € | -6.000 € | -29 % |

Pain points remain/sales decline |

| Option A |

Optimize folder structure on file server |

15.000 € | 2.000 € | 12.000 € | 58 % |

limited effect |

| Option B (TESSA DAM) |

Introduction of a fully-fledged DAM |

40.000 € | 12.000 € | 55.000 € | 164 % | Change Management |

Someone may directly address the negative ROI in your table. The assumption behind this question is often that if you don't invest anything, the result can only be zero. However, this is not true in dynamic markets. If you lose market share because competitors become more visible by introducing a DAM system and you don't, this will lead to a loss of revenue. You lose market share and thus have a negative ROI without having invested anything.

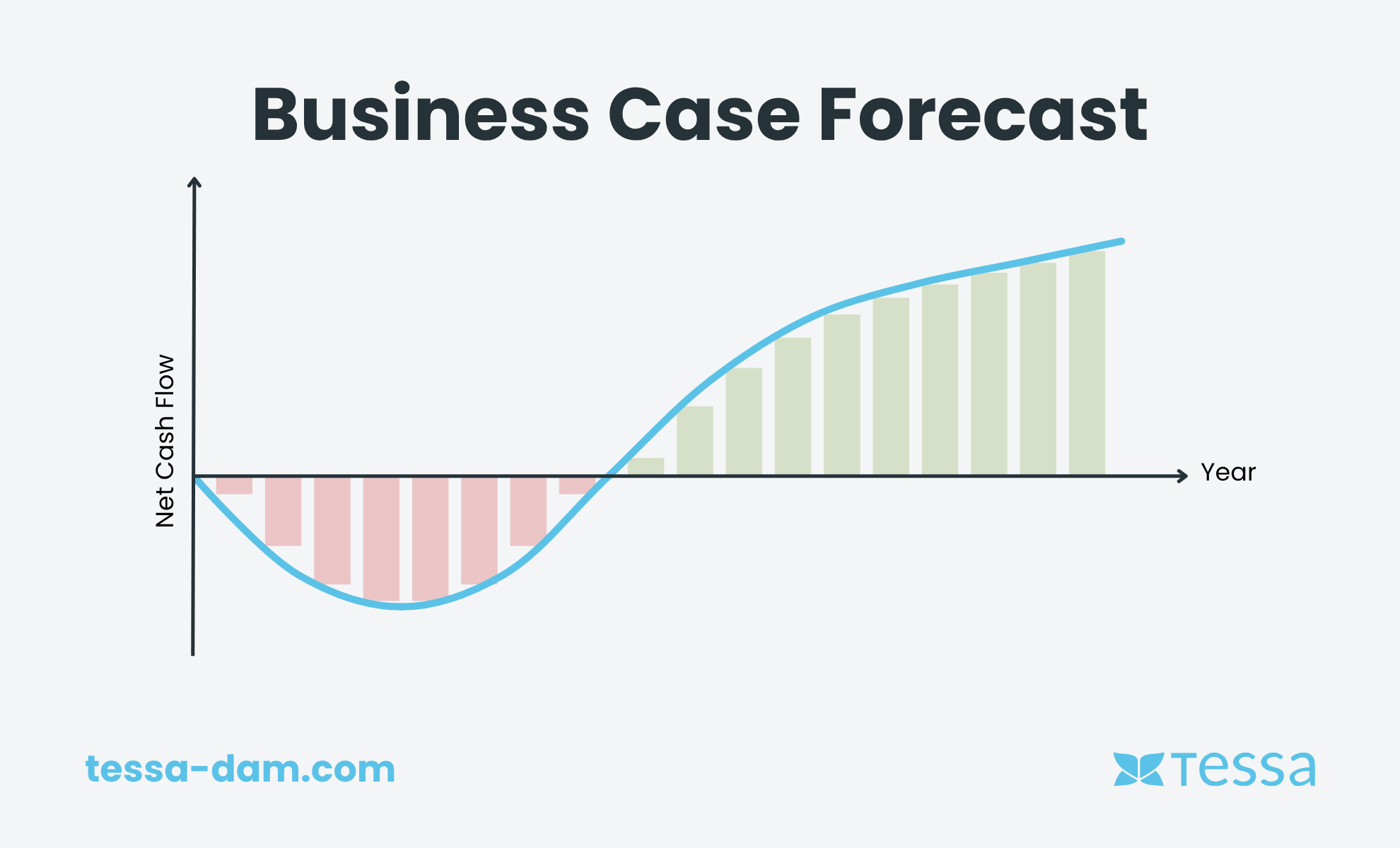

4. Cost-benefit analysis

This includes all relevant expenses, such as licenses, implementation, and training, as well as monetized benefits such as time savings, revenue uplift, or risk minimization. Ideally, work with cash flows rather than one-time amounts to realistically represent the course of investments and benefits. Back up your estimates with concrete assumptions: Which processes can be optimized and what savings will this generate?

Which additional marketplaces can you serve in the future and what revenue uplift is associated with this?

5. Risks and sensitivities

No project is risk-free. Identify technical, organizational, and financial risks, assess the probability of occurrence and extent of damage, and define appropriate countermeasures.

6. Action & Project Plan

In any case, you need a rough schedule, from kick-off to MVP (Most Viable Product) to roll-out. Roles and responsibilities (for example, in the form of a RACI matrix) ensure that everyone knows what to expect.

You should include not only the most important dates in the schedule, but also the time required for each task. This is particularly helpful if the start dates change.

7. Summary of the analysis

Ultimately, your bosses or management don't need 30 pages full of details, but rather a clear decision-making template. An executive summary of one to two pages, combined with a traffic light graphic, is usually sufficient.

However, you should definitely have a comprehensive analysis at your disposal. If there are any questions, you can then pass this on directly as evidence.

Practical example: Introduction of a digital asset management system – TESSA DAM

To bring the theory to life, we will follow a fictional medium-sized e-commerce company called Woody Living. The furniture retailer operates five online shops in three countries, works with 120 resellers, and manages around 60.000 image and video files.

1. Situation analysis at Woody Living

- Assets are stored in a decentralized manner on file servers, Dropbox, and agency FTP.

- Product photos are requested multiple times for each marketing campaign because no one knows where the current version is located.

- The time-to-market for new collections is five days.

- Outdated images often end up in the shop, which increases the return rate and support costs.

2. Target

Woody Living aims to reduce asset search time by 90%, time-to-market by 50%, and the return rate by 1 percentage point. At the same time, a self-service portal for retailers is to be created to reduce costs within the company. In addition, more retailers and marketplaces are to be connected.

3. Option comparison

- Do nothing: Pain points remain, competitiveness declines, and there is a risk of lost revenue because competitors are presenting their products online in ever greater detail.

- Clean up the folder structure: Low investment, but only short-term relief. There is no real step forward.

- Introduce TESSA DAM: Higher initial costs, but scalable, centralized media management plus automation and self-service through the TESSA BrandHub.

4. Calculation

|

Key figure |

Assumption |

Year 1 | Year 2 | Year 3 |

|

Invest (Implemention) |

once | -40.000 € | - | - |

|

Licenses & Operation |

11.400 €/Year | -11.400 € | -11.400 € | -11.400 € |

|

Time savings Marketing |

160 h/Month x 37,50 € | +72.000 € | +72.000 € | +72.000 € |

|

Returns reduction |

-1 pp. of 10 Mio. € turnover | +100.000 € | +103.000 € | +106.090 € |

|

Turnover-Uplift |

+3 % | +300.000 € | +309.000 € | +303.183 € |

|

Net Cashflow |

+420.600 € | +472.600 € | +469.873 € |

Break‑Even: 2 Months.

ROI after 3 years: 1.900 %

Even if the ROI turns out to be lower because a more powerful DAM is needed or the values were chosen too optimistically, introducing a DAM still makes perfect sense!

5. Risks & Countermeasures

|

Risks |

Admission |

Effects |

Countermeasure |

|

Low acceptance among users |

medium |

delayed ROI |

Training courses, pilot group |

|

Data migration incorrect |

low | zusätzlicher Aufwand | Testmigration, Migrationsskripte |

|

Interface to PIM unstable |

low | Media-Outage | API-Monitoring, Fallback-CDN |

Users are the biggest risk. EIKONA Media has extensive experience in data migration and connection to PIM systems, so these risks are usually factored into the setup costs.

6. Project‑ and Actionplan

- Kick-off & scoping (2 weeks): Stakeholder workshop, finalize requirements.

- Implementation (8 weeks): Set up TESSA instance, data model, rights concept, interfaces.

- Pilot phase (4 weeks): Marketing & e-commerce testing upload/download flows.

- Rollout (2 weeks): Training for retailers, agency partners, global go-live.

- Hypercare (4 weeks): Support hotline, KPI monitoring.

7. Executive‑Summary

Recommendation: Introduction of TESSA DAM

Investment: €51,400 initial costs, €11,400 per year

Break-even point: 2 months

ROI (3 years): 1,900%

Risk: moderate, manageable through training & monitoring

Tools & templates for your business case

So you don't have to start from scratch, here are some tried-and-tested tools to help you:

- TESSA Consulting: We help you identify and evaluate potential for increasing efficiency and sales through a DAM in your company.

- Excel BC template: Collaborative work with versioning.

- Lucidchart: Visualize decision trees and data flows.

- Miro: Stakeholder mapping and for pain point workshops.

- Canva or PowerPoint: Design executive slides in CI colors.

If we don't have something like this, maybe we should make it available. Otherwise, we should delete the item.

Our 7 professional tips for creation and presentation

- Lead with the outcome. Start with the result (i.e., your recommendation), not with the history.

- Monetize time. Hours are only relevant when they are expressed in dollars.

- Think in terms of scenarios. Best-case, worst-case, and real-case scenarios create credibility.

- Interview stakeholders first. Agree on assumptions early on; surprises later on lead to wasted time and cause frustration.

- Two levels. Slide deck for decision-makers, detailed document for analysts, especially in larger companies.

- Tell a story. Pain-exciting-solution sticks.

Follow-up plan. Lobbying begins after the presentation. Plan targeted touchpoints.

Conclusion

Clear distinction between “nice to have” and “mission critical”

Those who analyze systematically, compare alternatives, and demonstrate the benefits in a comprehensible manner build trust and secure budgets. The practical example of Woody Living shows that introducing a DAM such as TESSA not only makes technical sense, but is also economically convincing. Use the structure presented here to base your project on reliable figures and position yourself clearly in the investment process.